CHARTS: Death of the coking coal contract

From:Shandong RZ Drilling Tools Co.,ltd. 2016-12-03Hits:943

Summary:CHARTS: Death of the coking coal contract

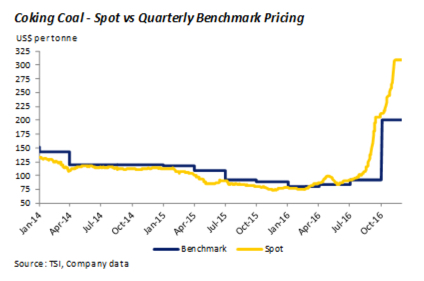

Coking coal prices retreated on Friday, but only slightly, holding above $300 a tonne after two months of insane gains.

According to data provided by the Steel Index premium Australia hard coking coal prices have tripled since the beginning of July exchanging hands for $308 this week following multi-year lows around $70 a tonne in November last year.

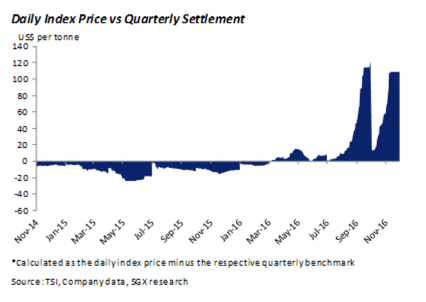

The surge in seaborne price is wreaking havoc on markets for the steelmaking raw material which is still traded on a quarterly contract basis.

Japanese steel mills and various Australian producers agreed to a price of $200 a tonne for premium coking coal deliveries over the last quarter of the calendar year.

While this represents a rise of 116% over the previous quarter, it's of course a very long way away from spot prices.

With first quarter 2017 negotiations due to kick off soon, how much longer producers will tolerate this discrepancy is unclear, but most bets are on met coal moving increasingly to a spot market just like the iron ore trade did a couple of years back.

The seaborne coal rally was spurred by supply issues after Beijing’s decision to limit coal mines' operating days to 276 or fewer a year from 330 before as it seeks to restructure the industry.

Chinese government stimulus plans which saw steel production pick up only added fuel to the fire, but much of the latest gains and volatility have been blamed on credit-fuelled speculation on futures markets in China, and may not reflect real demand